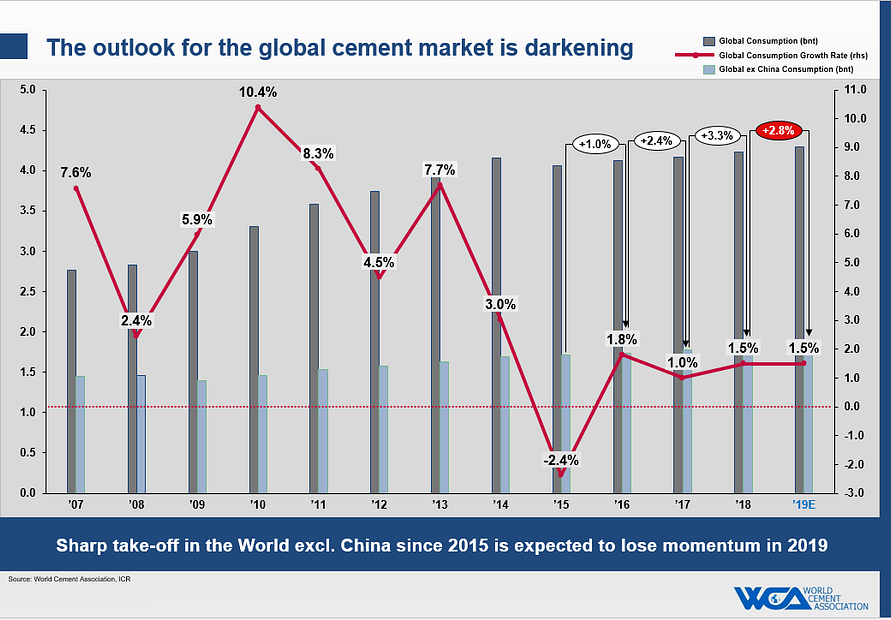

Global demand for cement is seen growing by 1.5 percent next year, the World Cement Association said on Wednesday, as economic risks and trade tensions weigh on the construction industry in many countries.

The demand forecast is an improvement from the 0.5 percent dip in cement volumes seen in 2018, and 1 percent increase during 2017, the trade association said.

Next year’s improvement is mainly down to a better situation in China, which consumes more than half of the world’s cement and where demand is expected to grow by 0.5 percent after two years of declines.

But outside China, the WCA foresaw subdued demand. In the world excluding China, it forecast cement demand to increase by 2.8 percent in 2019, down from a 3.3 percent rise in 2018.

The body, which has 72 members, cited rising economic risks and companies’ shuttering plants to tackle over-capacity as the main reasons for the deceleration.

“Overall WCA forecasts indicate 2019 will be a year when the world cement market will see subdued demand, and the outlook is relatively weaker than 2017 and 2018,” it said, adding the year ahead would be “challenging” for many cement producers.

LafargeHolcim (LHN.S), the world’s largest cement company, last week said it expected its 2019 sales to grow at a slower rate than in 2018, although it expects core profit to grow faster than sales as it cuts costs.

In 2019, the WCA expects the U.S. cement market will grow by 3 percent, lower than the 4 percent rate in 2018, after President Donald Trump’s large infrastructure investments failed to materialize.

Demand in Germany is expected to remain flat, while political uncertainty in Italy will likely hit demand there, the WCA said.

Turkey will see a significant downturn, it added, while Saudi Arabia and Malaysia will also see reduced cement demand.